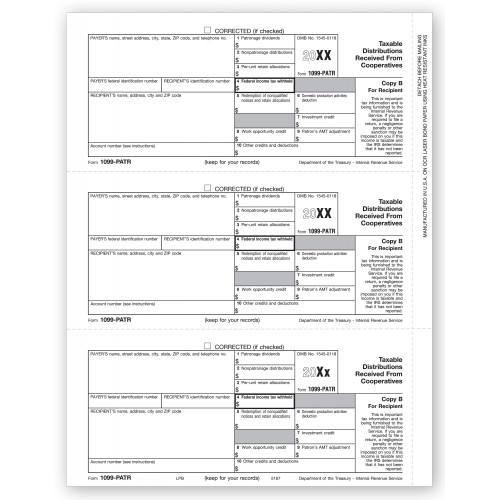

TF5167, Laser 1099-PATR Recipient Copy B

- Item# TF5167

- Size: 8 1/2" x 11"

- Recipient Copy B

- Three 1099's per sheet

- 100 forms per package

- Min. Order: 100

Related Products

Meets all government and IRS filing requirements.Popular format is ideal for reporting taxable distributions received from cooperatives.

Paper Filing Due Date: To Recipient January 31st.

For-profit cooperatives enjoy a special treatment in regard to federal taxes despite being taxed as normal corporations. For reducing their tax liability they often issue patronage dividends, which are basically refunds issued to patrons and based on the amount of goods purchased at the cooperative. The cooperative gets to deduct these dividends from its annual income. In the hands of the recipient, this is taxed as regular dividend they may also contain a minimum tax adjustment. All this is reported in tax form 1099-PATR to the IRS. A copy is sent to the recipient of the patronage dividend, the printable recipient copy that you see on this page.

Our printable tax forms comply with IRS regulations and you can sure that they are updated with the latest amendments, if any.

Don't forget the compatible envelopes: TF22222

There are no reviews for this product.

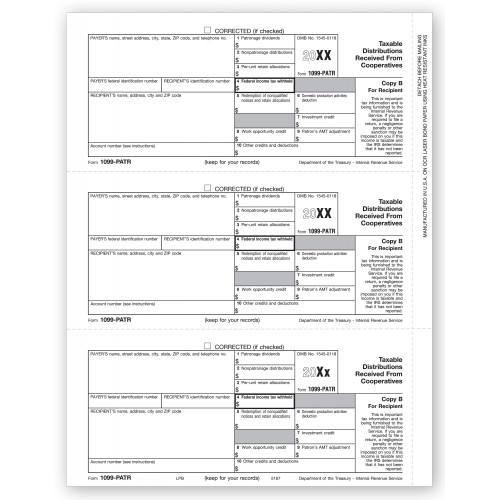

TF5167, Laser 1099-PATR Recipient Copy B

- Item# TF5167

- Size: 8 1/2" x 11"

- Recipient Copy B

- Three 1099's per sheet

- 100 forms per package

- Min. Order: 100